I recently wrote about why it’s so important for me to pay off our trips before we even go on them. It’s the only way I can relax and have fun – and NOT think about how much everything is costing! But I realized I didn’t explain HOW I save enough to actually pay these adventures off!

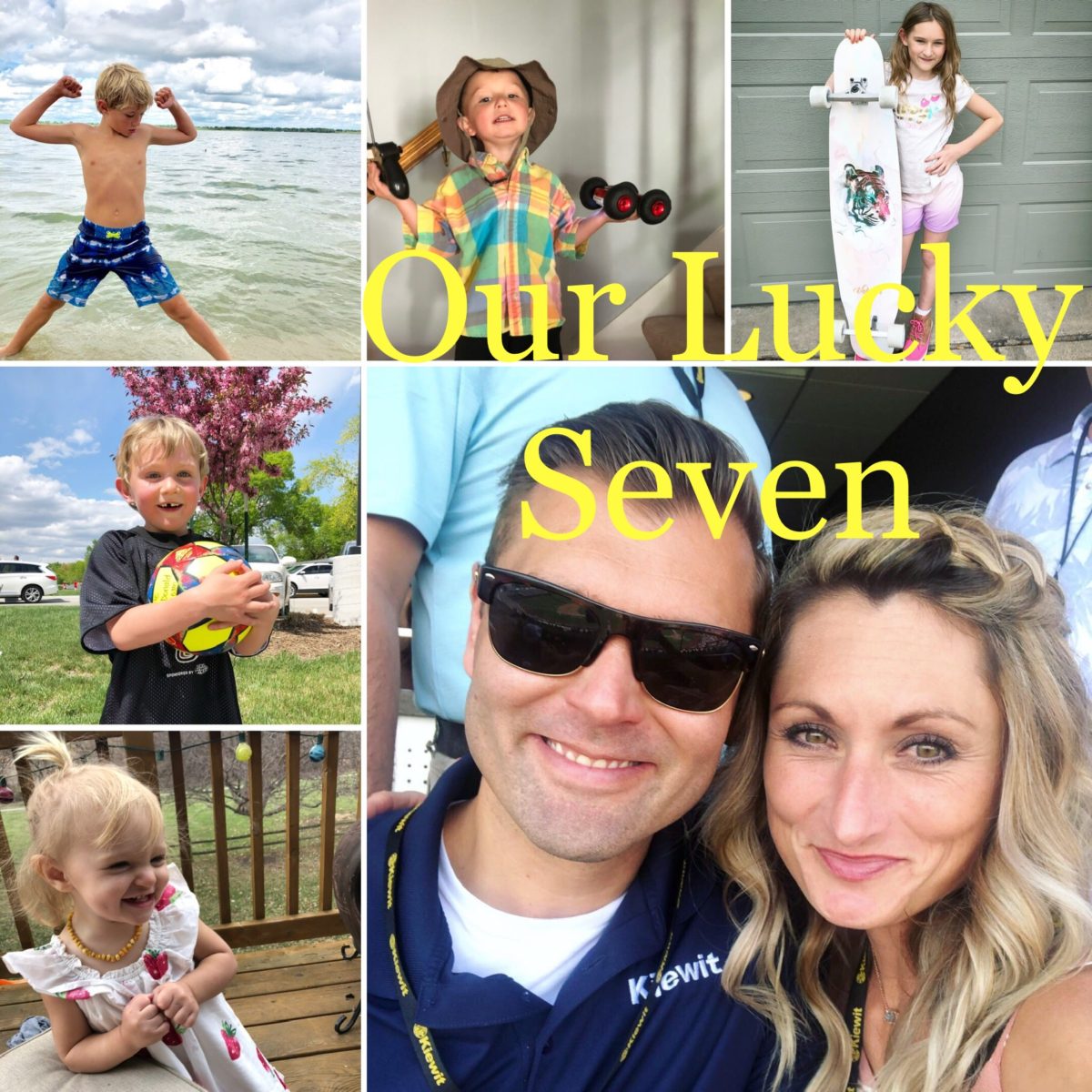

Don’t get me wrong, this budgeting thing is not easy. We are not growing a money tree over here, either. We are in the thick of childhood – and only have 3 of the 5 kids in year round sports so far. We pay a mortgage payment (more!) in healthy foods each month – and if you think homeschooling is free, think again. The way we are doing it, it’s as if we are paying for private school! So yes, money is tight. It’s always tight. We have to triple think every purchase before it is made, and always consider savings accounts first.

But there are a few things that I have learned throughout the last few years. I have found these small things add up to big trips for our large family!

10 Ways to Save Money for a Trip

Take extra cash out when grocery shopping and save it.

Even if it means you put back a few ‘treats.’ Withdraw $20-40 each week to stuff inside of your travel account. This can include all change you are handed back when paying in cash, too.

Automatically transfer money to a vacation fund.

Our paychecks are direct deposited, and I have $100 immediately taken out and transferred to a vacation account. If you set it up to automatically do this, you won’t even realize that money is gone.

Cancel/put on hold any memberships such as the gym or audiobooks.

Most families are paying for things they aren’t using, or things they could do without for a little while. I found that I was paying an annual subscription for several educational apps ($30-50 each for a year!) that my kids maybe toyed with here and there. Those were cancelled immediately, and we put our crazy expensive gym membership on hold whenever we need to save quick.

Create an actual budget so you know where your money is going.

This is key so that you know where your money is going. It doesn’t just disappear, you (and I) spend it. Create a spread sheet with the last 12 months on it so you can see your trends. You’ll be shocked how much you spend on Starbucks.

Stop spending money on unnecessary things…

Such as fast food, restaurants, expensive (or cheap) coffee, happy hour, lavish date nights, or even just bottled water—- pack food, reuse cups, eat at home, etc.

After you’ve looked at your spending habits and created a realistic budget, you’ll naturally want to cut out this excess spending. Fast food is junk, and it adds up fast! Those coffees, happy hours, and quick errands will put your vacation on hold.

Second guess yourself before spending money, and hold yourself accountable.

This is where my Target trips come in. I have to ask myself if it is even necessary to walk in those doors? Is it a need or a want? Stop yourself before running out for that ‘one thing’ that always leads to $50 blown.

Shop consignment stores for kids clothes.

If you look regularly, you’ll get the newest stuff! I would guess that 80% of my kids’ closets are previously owned items.

Meal plan and stick to your list.

Take the time each week to plan our your dinner menu, utilizing similar ingredients to save money and buy in bulk. Cook larger batches to roll over into lunches, too.

Make money on the side.

Babysit, wait tables, take an extra shift.

If you are really trying to save large funds, consider taking on extra money-making hours. Sleep is still needed, but you can find a way to make a couple hundred dollars by selling items/toys/clothes in your house, picking up a weekend serving job, babysitting, or even taking those cheesy online surveys.

Get your kids on board.

If the entire family understands why you are saving money, they will be less inclined to asking for additional money. My kids host lemonade and cookie stands, car washes, and ask neighbors to pull weeds to earn a few dollars to contribute.