June

begins the first month of summer. It is a time of pure heated bliss, with pool days, dirty feet, and careless spending….

Back that up right quick.

Does anyone else fall into the trap of overspending on complete and useless crap throughout the summer?

We just emptied our accounts to buy an amazing house. June marks 3 months of homeownership here! Whoop! Why have we not started replenishing our bank accounts? I’ll tell you why…

House projects added up quick; we renovated the fireplace and ripped out the kitchen tile. What we thought would be easy weekend tasks turned into two months of work. I can’t complain about the extra time and money because it looks phenomenal.

But then there was my careless home shopping sprees! New bedding and décor for all of the kid rooms, glass jars to line the kitchen and turn us into a more eco-conscious home… and all of the other ridiculous, late-night amazon purchases that were not needed.

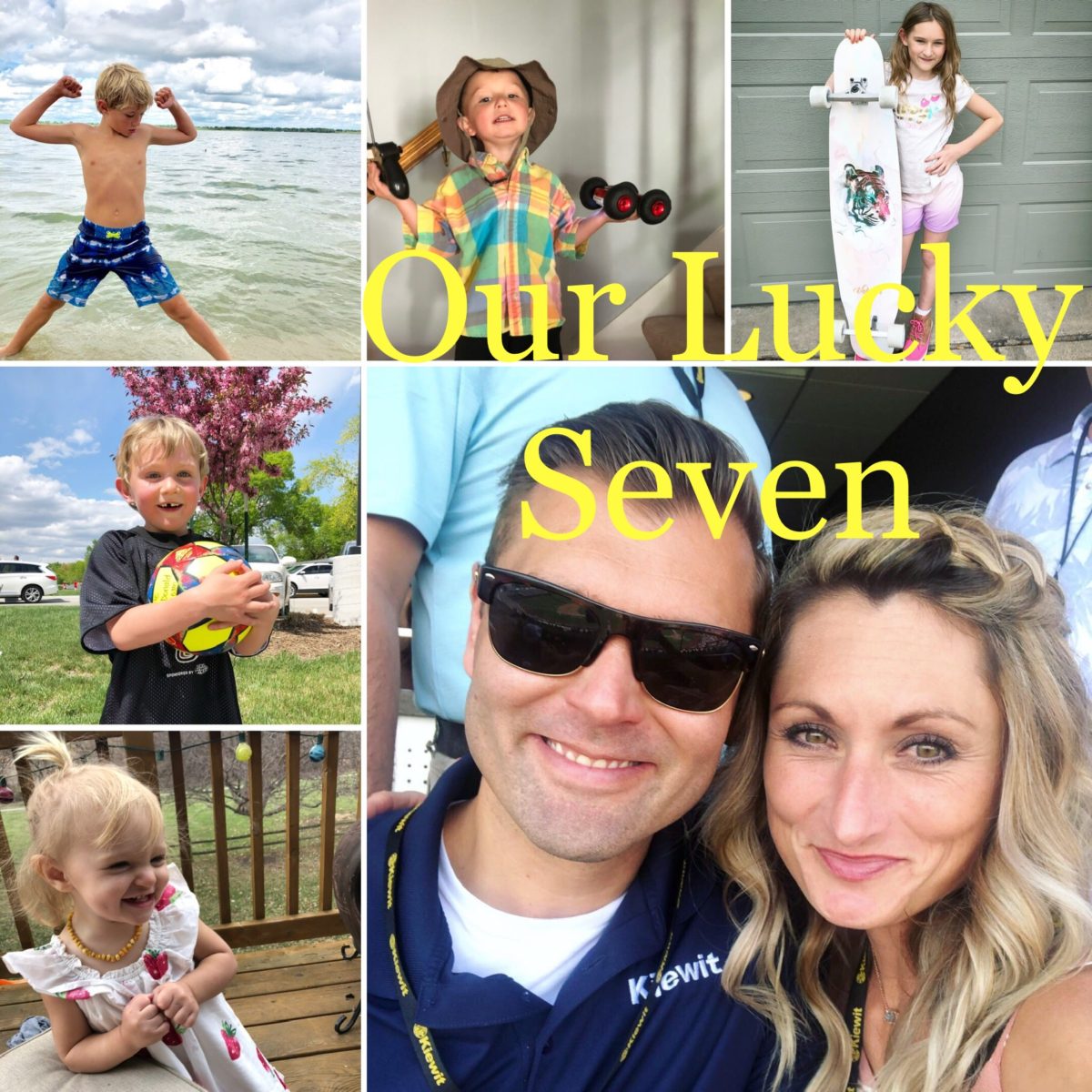

I am your typical mom-to-a-lot-of kids… I give in and order pizza, rent the movie, throw crap in the cart that is never needed. It’s a problem… ha.

Our flower beds look gorgeous and the house is at a stopping point until our next project this fall, so it’s time to start seriously saving some money. We have an awesome trip planned for the week of July 4th; we have a 5th baby coming in late August; we want to take a killer trip this winter, and we need to just rebuild the accounts.

We are going on a 30-day NO SPEND Spree. That means that nothing other than bills, gas, and groceries are purchased this month. It sounds easy right? But if you are anything like me, the ice-cream shop screams our names as we drive home from the pool… iTunes will probably put out a few great kid movies to add to the collection (and make for an easy weekend at some point)… Holy Hell — Target is just f’ing Target – the money-sucking happiest place on earth.

I will need to avoid Target and Amazon like the plague to successfully complete this challenge.

If I (well, we – the husband needs to stop buying lunch out everyday, and step away from Home Depot) can complete this task, we should be able to pay off everything from the house renovations and start seeing cash flow back into those savings accounts!

Who else out there is in need of a little discipline. This means no snack bar treats at the pool, no date nights, no late-night clicking and spending!

I understand that this seems insane to so many of you reading, but I can’t be alone here.

I’ll let you know how we do – keep me updated on your self-discipline tactics and progress throughout the month too.